Understanding Indirect (Facilities and Administration) Costs and Addressing Common Myths

What are Indirect (Facilities and Administration) Costs?

Indirect costs refer to expenses that are necessary to support research but are not easily linked to a specific research project. Indirect costs are sometimes called Facilities and Administrative (F&A) costs or overhead costs.

Examples of indirect costs include reimbursing for portions of:

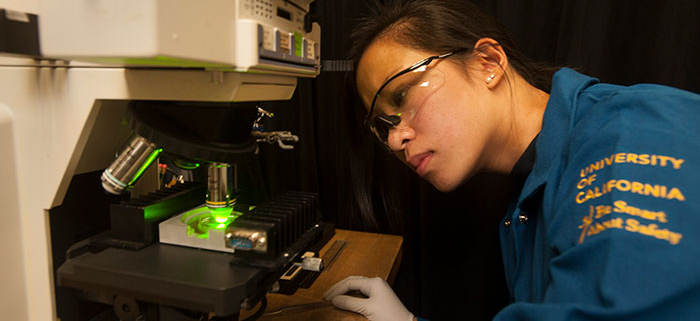

- State-of-the-art research labs

- Personnel to support accounting and administration

- Compliance support (e.g., human subject protections, export control, and research security)

- High-speed data processing

- Library resources

- IT Services

- Utilities

How are Indirect Cost Rates Established?

Indirect costs rates are negotiated between a cognizant agency assigned by the federal government and the University. The Department of Health and Human Services (HHS) – Cost Allocation Services is responsible for reviewing and approving legally binding rates for the University of California. These negotiated indirect costs rates are generally applied to each funded research project to cover their share of the institution’s indirect costs.

The percentage is based on detailed historical cost data submitted to HHS in accordance with federal cost principles (2CFR 200). The data includes a rigorous review of:

- The institution’s expenses for facilities, operations and administrative support, and

- The volume of all funded research.

A review is conducted every 3-4 years as part of the indirect cost rate negotiation process.

Why is Indirect Cost Reimbursement Important?

Research drives innovation, strengthens national security, and improves public well-being. By investing in research, partners support the U.S. economy to address critical challenges such as climate change, energy efficiency, cybersecurity, and social inequalities. It is through research that we not only solve problems but also create new economic opportunities in emerging sectors that support economic growth and help the U.S. remain competitive globally.

Indirect cost recovery allows research institutions to:

- Cover the cost of actual expenses that are essential for the institution to conduct research.

- Allocate to the funding agency their share of the institutional infrastructure necessary to support and conduct the research (such as facilities, equipment, and personnel).

- Ensures the long-term financial stability of our national research environment to adequately support groundbreaking discoveries and innovations.

- Support the costs of ensuring compliance with grant management and other administrative functions necessary for research oversight.

- Sustain the research infrastructure that provides access to the vast pool of expertise, talent, and cutting-edge facilities that make U.S. growth possible.

Key Takeaways

- Reimbursement of indirect costs cover the institution’s actual expenses necessary to support research.

- Rates are based on detailed negotiations with the institution’s federal cognizant agency and costs are verified by detailed audits and reviews.

- Indirect costs are essential for maintaining research facilities that comply with federal regulations and allow the U.S. to compete in a global environment, leading to scientific, medical, military, economic, and other innovative advances.

- Insufficient reimbursement of indirect cost funds limits the institution’s capacity to support research and disincentivizes them from investing in cutting edge facilities.

Myths vs. Facts

Many myths and misunderstandings exist about indirect cost rates, often leading to confusion or incorrect assumptions.

Click on each myth below to see the related facts.

Myth - F&A costs are not necessary for conducting research.

Fact – To conduct research, institutions need to make significant investments in infrastructure (labs, equipment) and operations (faculty, grad students, staff) necessary for research. F&A costs reimburse institutions for these expenses.

While these costs may not be easily linked to individual research projects, they are real and actual costs incurred by institutions to sustain research.

Myth - F&A costs are administrative bloat.

Fact – F&A costs fund critical infrastructure like research labs, high-speed computing, libraries, and utility costs. They also support regulatory compliance, such as requirements for human subjects, laboratory safety, and national security protection to ensure research is conducted safely, ethically, and responsibly.

Reimbursement for administrative expenses is capped at 26 percent. Institutional costs that exceed this are not reimbursable and must be covered by the university. Therefore, universities have every incentive to contain costs as they must pay the entire bill and are only reimbursed for partial expenses when (and if) federal research is conducted.

Myth - If a university has an F&A rate of over 50 percent, it means they spend more than half their federal grant money to pay for F&A costs.

Fact – A university’s F&A cost rate is not in reference to the total grant, but rather only a subset of the research project’s direct costs. Currently, the average amount paid to universities for F&A expenses is approximately 25-33 percent of the total amount of a grant. (Campuses with medical centers tend to be closer to 33 percent because of the higher costs involved in providing for medical research facilities.)

Myth - F&A costs siphon money away from actual scientific research.

Fact – Lower F&A costs do not mean more money for research; instead, they represent a reduction in the funds available to support the broader research infrastructure and administrative needs of an institution.

Paying F&A is necessary for research and reducing F&A funding leads to diminished research capacity, deterioration of research facilities, and loss of scientific talent. Institutions may have to scale back research programs due to insufficient funding for essential infrastructure and operations. Without adequate F&A funding, research facilities may fall into disrepair, impacting the quality and safety of research. Researchers may be forced to leave institutions that cannot afford to maintain a robust research environment, leading to a loss of valuable expertise.

Myth - Foundations and the federal government categorize the reimbursement of F&A costs in the same way.

Fact – Federal F&A rates have been negotiated between universities and the federal government on an ongoing basis for decades. The University has been a partner in the negotiation process and supports transparency by providing the government detailed cost data according to federal cost principles (2 CFR 200) to establish the rate. Foundations establish their own policy for determining the allowability of direct vs. F&A costs. They often classify certain expenses as “direct costs” where federal rules for universities require similar costs to be categorized as F&A costs. Federal funding and foundation grants have different rules about what expenses they can cover. This means there are key differences in how costs are categorized for each. Regardless of the nuanced differences, the fact remains that both direct and F&A costs are necessary and real research expenses.

Myth - If a foundation caps its F&A reimbursement at 15 percent, the federal government is subsidizing the research.

Fact – Federal cost principles require that F&A costs are allocated fully and consistently to all benefitting activities, regardless of whether a sponsor fully reimburses the institution. This ensures that all research is costed consistently. If a sponsor under-reimburses F&A, the institution is subsidizing the work. Non-federal sponsors operate under a different paradigm than federal agencies. F&A cost rate limitations often can be mitigated by greater latitude in direct charging allowable items.

Myth - F&A costs to universities are wasting taxpayer dollars.

Fact – The federal government invests in university research because it gets a strong return in the form of life-saving treatments and improved health outcomes that affect all Americans and ultimately save taxpayers money. Universities carefully steward taxpayer dollars spent on biomedical research with robust oversight. As compared to the private sector, universities charge lower F&A rates, do not have profit margins, and are subject to an administrative costs cap. For more information on how indirect costs are used by research universities and how important they are, consult the Association of American Medical Colleges (AAMC) informational page on indirect/facilities and administrative costs: https://www.aamc.org/what-we-do/mission-areas/medical-research/facilities-administrative-costs

Myth - F&A rates paid to universities have skyrocketed in recent years.

Fact – F&A reimbursement rates to universities have remained stable at roughly 27-28 percent of total federal research funding since 1991. Meanwhile, university spending on faculty research has surged by 65 percent since 2010, surpassing all other sectors, including overall federal spending on university research, which has increased by 13 percent.

Myth - Federal F&A rates are established arbitrarily.

Fact – Federal F&A rates have been negotiated between universities and the federal government on an ongoing basis for decades based on detailed research expenditure data. Universities use these negotiated rates to make important long-term budgeting, hiring, and other administrative decisions and to fund research and innovation cycles that are needed for long-term discoveries. The federal government reviews these rates every 3-4 years, including examining the institution’s infrastructure and operations.

Myth - Universities do not contribute their fair share to cover research costs.

Fact – Federal F&A reimbursements do not fully cover the F&A costs of university research, so universities commit their own funding to make up the difference. A study by the Association of American Medical Colleges demonstrated that for every dollar in NIH awards an academic health center receives, they spend an additional 53 cents to support that science. The largest driver of this shortfall is unreimbursed facilities and administrative costs. Due to rising regulatory compliance costs, institutional support for research has increased while the federal government’s share has decreased. Any cuts to F&A reimbursement would cripple our nation’s research and innovation enterprise.

Myth - The cuts will not significantly impact the University of California due to its diverse funding sources.

Fact – The NIH is the largest funder of UC research, with funding totaling $2.6 billion in the last academic year. A reduction of this scale would have a profound impact on the UC system, creating significant gaps in funding that supports research facilities and staff. These cuts could challenge our ability to fully carry out our mission in education, patient care, and research.