COI FAQs

- Examples of Financial Conflicts of Interest (FCOI)

- Form 700-U

- Form 800

- PHS Form

- Supplemental Form

- Electronic Filing System (eCOI)

Examples of Financial Conflicts of Interest (FCOI)

Outside Activities That May Create a FCOI

- Holding equity interests (i.e. stock) in an entity that supports your UCD research:

- Holding any of these positions in an entity that supports your UCD research:

- Office or membership on a board of committee

- Director, officer, partner, trustee, employee, or management (without or without income or equity)

- Founder, co-founder, or shareholder

- Accepting the following from an entity that supports your UCD research:

- Travel reimbursement from a sponsor to attend board meetings.

- Honoraria for lectures at companies whose financial interests are affected by your University research.

- Income, gifts, or loans

- Consulting income where the consulting activity could reasonably appear to be related to the research project.

- Financial interest in a business entity that:

- Develops, manufactures, or improves a product or offers services related to the research project.

- Predictably result from the research project.

- Will act as a vendor, subcontractor, lessor, or other participants on the research project.

- Is related to intellectual property in which the investigator is named as an inventor if the research project could reasonably appear to be affected by the interest.

Definitions for All Forms

Investigator – Any individual who is responsible for the design, conduct, or reporting of the research. This includes the Principal Investigator (PI) and others responsible for the scientific development or execution of the project and those with direct control over subject selection, data collection, or data analysis, regardless of salaries or compensation. This does not include individuals whose duties are limited to the execution of the approved protocol under the oversight of the PI, technical support, or purely advisory involvement in the project.

New Significant Financial Interest –

- A financial interest that previously did not exist; or previously did not meet the reporting threshold but has increased in value to meet or exceed the reporting threshold; or

- A different type or nature of SFI than what had previously been disclosed from the same source that meets or exceeds the threshold (e.g., royalty payment versus consulting fees); or

- The same type or nature of SFI from a different source such s royalty payment from company A versus company B.

Form 700-U

Definitions as they apply to Form 700-U only:

Investment – For Form 700-U Only – Investment means any financial interest in a business entity in which you, your spouse or registered domestic partner, or your dependent children have a direct, indirect, or beneficial interest totaling $2,000 or more. Reportable investments include stocks, bonds, warrants, and options, including those held in margin or brokerage accounts (See Gov. Code Section 82034 and Regulation 18237).

Income – For Form 700-U Only – Income means a payment received, including but not limited to any salary, wage, advance, dividend, interest, rent, proceeds from any sale, gift, including any gift of food or beverage, loan forgiveness or payment of indebtedness received by the filer, reimbursement for expenses, per diem, or contribution to an insurance or pension program paid by any person other than an employer, and any community property interest in income of a spouse or registered domestic partner. Income also includes an outstanding loan. The income of an individual also includes a pro-rata share of any income of any business entity or trust in which the individual, spouse, or registered domestic partner owns directly, indirectly, or beneficially, a 10% interest or greater. Income includes your gross income and your community property interest in your spouse’s or registered domestic partner’s gross income totaling $500 or more. Gross income is the total amount of income before deducting expenses, losses, or taxes. (See Gov. Code Section 82030).

Loan – For Form 700-U Only – Loans received or outstanding are reportable if they total $500 or more from a single lender. Your community property interest in loans received by your spouse or registered domestic partner also must be reported. Loans from commercial lending institutions made in the lender’s regular course of business on terms available to members of the public without regard to your official status are not reportable. (See Gov. Code Section 82030(a)).

Gift – For Form 700-U Only – A gift is anything of value for which you have not provided equal or greater consideration to the donor. A gift is reportable if its fair market value is $50 or more. In addition, multiple gifts totaling $50 or more received from a reportable source must be reported. It is the acceptance of a gift, not the ultimate use to which it is put, that imposes your reporting obligation. Therefore you must report a gift even if you never used it or if you gave it away to another person. If the exact amount of a gift is not known, you must make a good faith estimate of the item’s fair market value. Listing the value of a gift as over $50 or value unknown is not adequate disclosure.

Commonly reportable gifts include:

-

- Tickets/passes to sporting or entertainment events

- Tickets/passes to amusement parks

- Parking passes

- Food, beverages, and accommodations, including those provided in direct connection with your attendance at a convention, conference, meeting, social event, meal, or like gathering

- Rebates/discounts not made in the regular course of business to members of the public without regard to official status

- Wedding gifts

- An honorarium received prior to filing an “initial” statement. You may report an honorarium as income rather than as a gift if you provided services of equal or greater value than the payment received.

- Transportation and lodging

- Forgiveness of a loan received by you

(See Gov. Code Section 82028).

Paid Travel – For Form 700-U Only – Travel payments include advances and reimbursements for travel and related expenses, including lodging and meals.

- Travel payments are gifts if you did not provide services that were equal to or greater in value than the payments received. You must disclose gifts totaling $50 or more from a single source during the period covered by the statement. Gifts of travel are reportable without regard to where the donor is located. When reporting travel payments which are gifts, you must provide a description of the gift and the date(s) received.

- Travel payments are income if you provided services that were equal to or greater in value than the payments received. You must disclose income totaling $500 or more from a single source during the period covered by the statement. The filer has the burden of proving the payments are income rather than gifts. When reporting travel payments as income, you must describe the services you provided in exchange for the payment. You are not required to disclose the date(s) for travel payments which are income

- You are not required to disclose:

- Travel payments received from any state, local, or federal government agency for which you provided services equal or greater in value than the payments received

- Travel payments received from your employer in the normal course of your employment

- Payments for admission to an event at which you make a speech, participate on a panel or make a substantive formal presentation, transportation, and necessary lodging, food, or beverages, and nominal non-cash benefits provided to you in connection with the event so long as both the following apply:

- The speech is for official agency business and you are representing your government agency in the course and scope of your official duties

- The payment is a lawful expenditure made only by a federal, state, or local government agency for purposes related to conducting that agency’s official business. Note: This exception does not apply to state or local elected officers and officials specified in Section 87200

- A travel payment that was received from a non-profit entity exempt from taxation under Internal Revenue Service Code Section 501(c)(3) for which you provided equal or greater consideration.

Form 700 FAQ’s

Who Fills out a 700-U? – If you are the PI and your research is privately funded. Not required for other investigators.

When do I complete a 700-U? – You must complete anytime funding is received (new, incremental, or supplemental) from a nongovernmental entity.

- Request to receive Material Transfer Agreement (MTA) from a nongovernmental sponsor where material(s) will be received by UCD personnel for research at UCD.

- A gift received from a nongovernmental entity earmarked for research for which the PI is responsible.

- No disclosure required if the entity is on the exempt list.

Should I only disclose income from the sponsor related to my research (e.g. protocol development, consulting on the specific project, etc.) on my 700U? – No, you must disclose any income (above the $500 threshold) received from the sponsor during the reporting period, regardless of the purpose or activity for which you received that income.

I am a co-investigator on the research project. Do I need to complete a 700-U? – No. Only the Principal Investigator (PI) completes the 700-U. If the project includes multiple PI’s (on a multi-PI project), only the lead PI completes the form (whoever is listed as the lead PI in Cayuse).

I just acquired a new financial outside interest. I have previously filed a 700-U for my project. Do I need to complete another 700-U? – No, another 700-U is only required at the time new, incremental or supplemental funding has been received.

If a study drug is being provided to the Principal Investigator (PI) by a for-profit company, is a 700-U required? – Yes. Per the 700-U instructions, “if the project is to be funded or supported, in whole or in part, by a contract or grant”, it’s required. In this case, the project is supported by the donation of the drug.

Do I need to submit a new 700-U for a contract amendment where the total amount of the study budget is now less than the original contract submission? – No.

Do I need to submit a new 700-U and Form 800 annually if I do not have any new or incremental funding or changes to my Significant Financial Interest (SFI). – It depends, see below.

- A 700-U is completed anytime funding is received (new, incremental, or supplemental) from a nongovernmental entity.

- A Form 800 is completed:

- At the time of proposal submission to the NSF, CIRM, UC Discovery Grants, or UCOP Special Programs (e.g. University Aids, California Breast Cancer, Tobacco-Related Disease).

- When a PI receives funds from a nongovernmental sponsor for research involving human subjects.

- Prior to the commencement of the project for departmentally funded HSR (human subject research).

- Within 30 days of acquiring a new SFI

- Annual Update for any investigator who previously submitted a positive Form 800 (if HSR).

The sponsor issued an award agreement in the amount of $60,000 and will issue the amount in yearly increments of $20,000. If I included the full amount of $60,000 on my 700-U, do I need to submit a 700-U form for each increment payment of $20,000? – Yes. Anytime a sponsor issues an award in increments, a 700-U is required to be submitted for each incremental amount upon receipt. In this scenario a total of 3 forms will be filed: (1) initial for year 1 for $20,000, (2) interim for year 2 for $20,000, and (3) interim for year 3 for $20,000. Note: Please wait for the award analyst from Sponsored Programs/Health Systems to request the 700-U as the form must be dated within 60 days of receipt of each incremental funding. This is to ensure all Significant Financial Interest (SFIs) (if any) are reported/captured for the last 12 month period.

If the funding entity is a non-profit research institute, do I need to complete a 700-U? – A 700-U is required from all profit and non-profit private entities unless the entity is a non-profit tax-exempt U.S. educational institution; or is on any of the following lists:

If the funding entity is a private university, such as University of Southern California, Stanford University, or John Hopkins University. Do I need to complete a 700-U? – This depends if the private university is a non-profit tax-exempt U.S. educational institution. University of Southern California, Stanford University, and John Hopkins University are all 501(c)(3) tax-exempt educational institutions, so a form 700-U is not required.

- 700-U Policy Clarified by UCOP: Link. The 700-U form has instructions that do not clarify if educational universities are exempt. UCOP has clarified this on its page to include: all non-profit, tax-exempt educational institutions are exempt from the disclosure requirement. So in cases where you are not sure if an institution is exempt, you could check to see if they are tax-exempt by getting their EIN number from Guidestar and entering it on the IRS

- Note: If the institution is a foreign educational institution, regardless if it is non-profit, tax-exempt, a 700-U is always required.

If the study has two sponsors and both are non-government entities, are two 700-U forms required? – Yes. A 700-U needs to be completed for both the prime and flow through a sponsor (one for each) unless they are exempt. A 700-U is required from all profit and non-profit private entities unless the entity is:

- A non-profit tax-exempt U.S. educational institution, or is on any of the following lists:

The 700-U asks if the payment was a gift or income for question 3.F. What is a gift? – “… anything of value for which you have not provided equal or greater consideration to the donor. A gift is reportable if its fair market value is $50 or more. In addition, multiple gifts totaling $50 or more received from a reportable source must be reported.”

In the last 12 months I received travel reimbursement income of $350 from the private funding entity that will be supporting my research. Do I need to report this on the 700-U? – No. Under Question 3.F., “Has the entity in Part 1 paid for your travel during the reporting period,” such travel reimbursement for the 12 months reporting period is only required if it meets the threshold of $500 or more.

Why must a PI on a privately-sponsored human research project file both a 700U and a Form 800? – The 700U disclosure focuses only on the PI’s outside financial relationship with the private sponsor. The Form 800 identifies whether any investigator has outside financial interests with other companies or entities that may be related to or interested in the research.

Form 800

Definitions as they apply to Form 800 only:

Significant Financial Interest (SFI) – For Form 800 Only Significant financial interest (per UC Davis PPM 230-05 II.I)—anything of significant monetary value, including but not limited to salary or other payments for services; equity interests (e.g., stocks, stock options or other ownership interests); intellectual property rights (e.g., patents, copyrights and royalties from such rights); or holding a position as an officer, director, agent, or employee of a business entity. Significant financial interest includes such interests held by a Principal Investigator or other Investigators and by their spouses, domestic partners, and/or dependent children. Note: Only income that exceeds $10,000 (aggregated, per entity) during the prior 12 months or that you expect to receive in the next 12 months must be disclosed. If the amount does not exceed $10,000, mark No.

Significant financial interest does NOT include:

-

- Salary, royalties, or other remuneration from the University.

- Income from seminars, lectures, or teaching engagements sponsored by public or nonprofit entities.

- Income from service on advisory committees or review panels for public or nonprofit entities.

- An equity interest in a public company that represents less than a 5% ownership interest and less than $10,000 in value as determined through reference to public prices.

- Annual salary, royalties, or other payments from any source other than those referenced in subparagraphs (1) and (2) above that individually or when aggregated do not exceed $10,000 over the next twelve months.

- Income from mutual funds and/or pension funds;

- A percentage of income received from the Veteran’s Administration Medical Center as part of physician reimbursement for University faculty;

- Interest in a business entity if the business entity is an applicant for Phase I support under the Small Business Innovation Research (SBIR) Program.

Related Significant Financial Interest (SFI) – For Form 800 Only (per UC Davis PPM 230-05, Exhibit A III.B) – When completing the Supplemental Form for a project sponsored by the federal government or other agency for which Form 800 is required, Principal Investigator and other Investigators shall consider all significant financial interests to determine if any are related to the sponsored project.

Examples include but are not limited to the following:

-

- Financial interest in a business entity that develops, manufactures, or improves a product or offers services related to the research project.

- Financial interest in a business entity that might manufacture or market a drug, device, procedure, or any other product used in the project or that will predictably result from the research project.

- Consulting income from a business entity where the consulting activity could reasonably appear to be related to the research project.

- Financial interest in a business entity that will act as a vendor, subcontractor, lessor, or other participants on the research project.

- Financial interest in a business entity that is related to intellectual property in which the investigator is named as an inventor if the research project could reasonably appear to be affected by the interest.

FAQ’s for Form 800

Who fills out a Form 800? – All Principal Investigators and Co-Investigators.

When do I fill out a Form 800? – At the time of the proposal for submission to the below entities:

- National Science Foundation (NSF)

- California Institute for Regenerative Medicine (CIRM)

- UC Discovery Grants

- UCOP Special Programs (e.g. University AIDS, California Breast Cancer, Tobacco-Related Disease

- When PI receives funds from a non-PHS sponsor (including any private sponsor) for research involving human subjects.

- Prior to the commencement of the project for departmentally funded HSR (human subject research).

- Within 30 days of acquiring a new SFI.

- At IRB Continuing Review, but only when there is an existing FCOI and management plan in effect.

I am a PI and just acquired a new reportable outside Significant Financial Interest (SFI). I have previously filed a Form 800 for my project. Do I need to complete an updated Form 800? – Yes. This form should be updated during the period of the award, either on an annual basis or within 30 days of when a new reportable significant financial interests is obtained.

Why must a PI on a privately-sponsored human research project file both a Form 700U and a Form 800? – The 700U disclosure focuses only on the PI’s outside financial relationship with the private sponsor. The Form 800 identifies whether any investigator has outside financial interests with other companies or entities that may be related to or interested in the research.

PHS Form

Definitions as they apply to Form PHS only:

Related Significant Financial Interest (SFI) – For PHS Only An SFI is related to a PHS-funded research project when the SFI: 1) could be affected by the PHS-funded research; or 2) the SFI is in an entity whose financial interests could be affected by the research.

- You MUST complete a PHS Form even if you do not have any reportable SFIs.

- You must include all outside activity on your PHS form regardless if the activity is related to your PHS-funded research. The Conflict of Interest Committee (COIC) will determine if the activity is a financial conflict of interest.

FAQ’s for Form PHS

Who fills out a PHS Form? – The PI, and any other person who has responsibility for the design, conduct, or reporting of research.

When do I fill out a PHS? – You MUST complete a PHS Form even if you do not have any reportable SFIs. You must include all outside activity on your PHS form regardless if the activity is related to your PHS-funded research. The Conflict of Interest Committee (COIC) will determine if the activity is a financial conflict of interest.

- At the time of the proposal for submission to any PHS entities (list on RCI website) with or without human subjects;

- When a project is transferred from another institution to UCD;

- Annually;

- Within 30 days following the acquisition of a new SFI.

I have outside financial activities that are unrelated to any of my PHS-funded research, do I need to include them on the form? – Yes. All outside financial activities need to be included on your PHS form at the time of proposal regardless if they are related to your PHS-funded research. There is a place on the form where you can state whether or not the activity is related to the PHS research and provide an explanation. The Conflict of Interest Committee (COIC), however, will determine if the activity is a financial conflict of interest.

Outside activities include, but are not limited to, consulting, equity, stocks, travel, membership on a board, or management positions.

I am an investigator for multiple research projects, some are NIH, one is NSF, and one is privately funded. Do I include all my projects on the PHS Form? – No. You should only include your PHS funded projects on the PHS Form. For the NSF project, you would complete a Form 800. For the privately funded project, you would complete a 700-U. If either the Form 800 or 700-U are positive, you would additionally complete a Supplemental Form for each.

I have a new Significant Financial Interest (SFI) to add on my PHS. When I click ‘Add SFI,’ I get the following message, ‘You have no SFI in this entity. Enter next entity or proceed to next section.’ – If you are entering an amount below the reporting threshold you will receive this error. Reporting thresholds are listed below:

- For publicly traded entities: $5,000 or more in income or equity

- For non-publicly traded entities: $5,000 or more in income or ANY amount of equity

- For travel: $5,000 or more

Does university salary constitute an outside financial interest that needs to be reported on the PHS form? – No. You are not required to disclose payments made by The Regents, including salary, stipends, royalty payments, honoraria, reimbursement of expenses, or any other remuneration from the University of California.

If a private sponsor has adopted the PHS regulations, do I also need to complete a 700-U?

- If the sponsor is on the FPPC Exempt List, a 700-U is not required (only the PHS Form).

- If the sponsor is NOT on the FPPC Exempt List, a 700-U is required by the PI. In addition, the PI and all other investigators must file a PHS form.

For a PHS sponsor, is Form 800 required if there are human subjects? – No, for PHS-funded research (including flow-through) with human subjects, ONLY complete the PHS Form (no Form 800).

Supplemental Form

Who fills out a Supplemental Form? – Principal Investigators and Co-Investigators.

When do I fill out a Supplemental Form? – Principal Investigators or co-investigators who answered yes to any questions (“positive”) on the 700-Us or Form 800s. Should be completed right after the 700-U and/or Form 800 is completed.

What is the purpose of the Supplemental Form? – To collect further information so the Conflict of Interest Committee (COIC) can timely decide whether outside interest presents a Financial Conflict of Interest (FCOI).

eCOI System

How do I add an Administrative Contact (For Principal Investigators Only).

- Make sure that you’re using Firefox or Chrome browsers

- Go to https://or-forms.ucdavis.edu

- You may need to log in using your Kerberos username and password

- At the top of the page, you will see a black bar menu. Select “Your Profile” from this menu.

- Click “+Add Administrative Contact”. In the box that appears, begin typing the last name of the person that you want to add. When their name appears in the pop-up box, select it. This person will now be able to initiate disclosures on your behalf.

- Click next to “Contact Number” and enter their phone number into the box that appears.

- To return to the form selection page, click on the blue “Home” in the upper left-hand corner of the page.

How do I initiate a PI Form for the Principal Investigator (for Administrative Contacts Only).

- Make sure that you’re using Firefox or Chrome browsers

- Go to https://or-forms.ucdavis.edu

- You may need to log in using your Kerberos username and password

- At the top of the page, you will see a black bar with a pull-down menu labeled “Administration”. Select “Initiate PI Form” from this menu.

- On the “Principal Investigator” pull-down menu, you will see a list of investigators for which you are the administrative contact. Select the appropriate name.

- Type the name of the sponsor into the box and select the sponsor’s name from the list that pops up.

- Underneath the “Research Project” drop-down menu, you will see a link that says “Can’t find your project?.” Click on this link and follow the instructions in the box that pops up.

- Select Form Type (700-U or 800). Please note that if the research is privately sponsored human subjects research, you will need to initiate both a Form 700-U and Form 800.

- Answer the remaining questions.

- Click the blue “Create Draft” button. This will create a draft that the investigator will be able to see when they log into the system, as well as send them an email notifying them that the draft forms are available.

How do I notify my Co-Investigators that they need to submit a Form 800 (For Principal Investigators Only)

- Make sure that you’re using Firefox or Chrome browsers

- Go to https://or-forms.ucdavis.edu

- You may need to log in using your Kerberos username and password

- At the very top of the page, in the black bar, you will see a drop-down menu labeled “Project Information”. Click on this menu and select “Non-PHS Projects”.

- On the project information page, you will see the project that you added earlier on the list of “Your Projects”. Click the radio button next to the project and click on the blue “Add Investigator” button. You can then add co-investigators to the project.

- Once you have added all of the investigators, you can click the yellow “Notify Investigators” button and follow the instructions in the pop-up window. This will notify your co-investigators that they are required to complete Form 800.

- To track whether or not your co-investigators have filed the necessary disclosures, you can always return to this page. The information under “Form 800 Filing Status” is updated in real-time.

I can’t find the Sponsor in the ‘Funding Entity Search’ field. – In most cases when you can’t find a sponsor it’s because you need to scroll through the list (see sidebar on the right to scroll down). There is an algorithm that lists the choices based on best match and since so many sponsors have names that have similar components (such as ‘research’ and ‘foundation’) and the options don’t always list as you might expect. Alternatively, you can enter the sponsor code to find the sponsor more quickly (can be obtained from your SPO analyst).

I created a Form 700-U in error today. Is there a way to delete the form? – No. The form cannot be deleted once created, however, you may email [email protected] and request that the form be archived.

I have a new Significant Financial Interest (SFI) to add on my PHS. When I click ‘Add SFI’, I get the following message, ‘You have no SFI in this entity. Enter next entity or proceed to next section.’ – If you are entering an amount below the reporting threshold you will receive this error. Reporting thresholds are listed below:

-

- For publicly traded entities: $5,000 or more in income or equity

- For non-publicly traded entities: $5,000 or more in income or ANY amount of equity

- For travel: $5,000 or more[/symple_toggle]

Can’t Create Form/Unable to Submit Form:

I can’t see the option, “Non-PHS Projects” neither can I create a new Online 700-U Form. – If this is your first time creating a COI disclosure form in the eCOI system you may not have PI access. Please email [email protected] and request PI access.

I am unable to submit my PHS/700-U/Form 800. It won’t let me sign or submit. – The system will not allow you to sign/submit the form unless you are logged in under the new DUO security.

System Errors:

I received this error message: There are no actions for you to take. – If this is your first time creating a COI disclosure form in the eCOI system you may not have PI access. Please email [email protected] and request PI access.

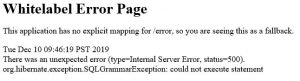

I received a ‘Whitelabel Error Page’ message.

If you manually typed in the project dates, this may be causing the error. Use the provided calendar to populate the date.

I received this error message:

![]()

There was an unexpected error (type-Internal Server Error). – The eCOI system is most compatible with Chrome or Firefox. Please use either Chrome or Firefox.